Email: emanuelealbertocirello.98@gmail.com

Total Article : 76

About Me:I am a Year 13 student which aspires to be an architect. I am interested in anything I don't yet know, and I mostly write about art, politics , Italian culture and inspirational people, although I will try to write for as many categories possible, just to test myself and get to know more things.

Iraq is the world’s eighth-largest oil producer, and its output last year, of three million barrels per day, was at the highest level it’s been since the 1980s. The fact that the price of oil is instead reducing shows how the petroleum market is getting weaker due to falling demands even if the supplies are growing.

The current crisis in Iraq also affects the oil that we buy. The conflicts due by ISIS in the neighbouring countries have also affected Iraq, as many areas of the country are seized by the terrorist group. This means that production of oil is affected, as it becomes more and more difficult.

Since the Gulf War, Iraq has been heavily affected and since then attracting foreign investment for wells and exploration has been difficult due to the unstable structure of the nation. Iraq produces 3.3m barrels of oil, but if more capital was to be invested this figure could rise.

This year, the price for oil was $105 per barrel, whereas now it stands at $113.50 per barrel. Generally the market for oil is speculative, but in general if there is trouble in the middle east the price is expected to rise. But this isn’t always true.

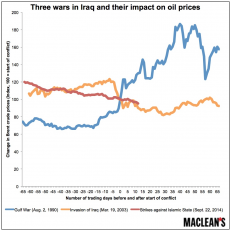

The graph shows that, during the Graph war, prices grew exponentially and from a mere $70 per barrel 20 days before the conflict, the price for oil peaked at $180 after the first month of the conflict. The Iraqi invasion of Kuwait, partly prompted by the low price of oil, led to uncertainty about production and prices spiked. Iraq wanted to gain control of the world's third largest oil producer to give it more control over the world market. Following the Gulf war to liberate Kuwait, crude oil prices entered a period of steady decline, reaching their lowest level in 1994 for 21 years.

The Iraqi invasion of Iran in the 1980’s also had a great effect on oil prices and oil production. Iran weakened by the revolution was invaded by Iraq in September 1980. By November, the combined oil production of the two countries was only one million barrels a day, 6.5m fewer barrels than the year before. It meant a worldwide reduction in crude oil production of 10%. The combination of the Iranian revolution and the Iran-Iraq war caused crude oil prices to more than double from $14 in 1978 to $35 in 1981.

However in the case of the invasion of Iraq in 2003, the oil prices fell significantly after the start of the conflict. This is due to the exploitation of resources and the western influence upon the country, which ensured the oil supplies to be cheap and largely available. The American-led invasion of Iraq led to the loss of oil production in the Gulf state. In mid- 2002, there were over six million barrels per day of excess production capacity and by mid 2003, this had dropped to below two million. It dropped still further in 2004-5. A million barrels per day is not enough spare capacity to cover for any sudden drop in production and it led to an increase in prices.

Image credits: http://www.macleans.ca/economy/economicanalysis/three-wars-in-iraq-and-their-impact-on-oil-prices/

0 Comment:

Be the first one to comment on this article.